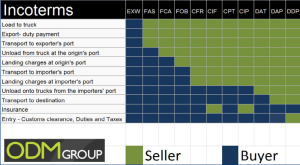

Import / Export Guidelines

Laurell Trade Guidelines

![]() Click here

for a chart outlining recommended Laurell trade guidelines.

Click here

for a chart outlining recommended Laurell trade guidelines.

Understanding VAT Tax — Europe & United Kingdom

Goods which are manufactured within the EU or the USA are free of customs duty, however, they may be subject to other EU State taxes such as excise and VAT.

VAT rates vary anywhere from ~7.5% to 25%.

Note: when returning items to the US for repair or upgrade make sure the words to describe your equipment are "Goods are of US origin, being returned for service". Customs in your country will always try to collect the VAT again, so always be prepared to prove that the tax was paid previously, or that you are exempt.

Custom Duties — None in the EU

There are NO import duties on Laurell Technologies equipment. The duties were suspended in 1994 — Our Tariff (HS Code) is: 8486 2000 00

Further Custom Duties info... http://www.export.gov/logistics/eg_main_018130.asp

Incidents reported to us:

Greece: DHL assigned a 3rd party carrier to deliver one of our systems to an outlying area — they attempted to collect a "Custom Duty" from one of our customers...DHL investigated, then discontinued their relationship for unscrupulous behavior. The customer refused to pay the false charges and received their equipment with only a sight delay.

Italy: An EU-based competitor, after losing an order to Laurell, complained that their system was free from all tax including VAT...the purchaser was informed by Laurell beforehand that this might happen and dismissed this notion immediately.

France: FedEx attempted to deliver a Laurell system which was consigned to a local carrier for final delivery — there was an attempt to collect a "Custom Duty" from our customer... but when it was refused, delivered the equipment and apologized for the misunderstanding which they had confused with the VAT which had been pre-paid. No further action was required and it was judged a misunderstanding by FedEx.

Disclaimer: While these stories are known by the writer to be generally factual (customer did NOT pay customs duties), some speculation was used to fill in missing detail (specifically DHL and FedEx agents indicated "off the record" that action was taken against offenders), but because nothing was ever documented, we still have doubts. It is still a case of buyer beware!

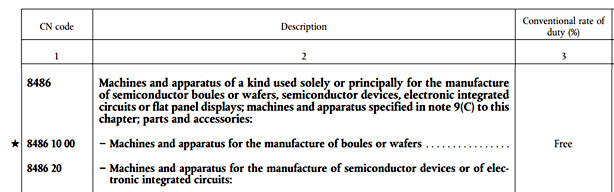

EU Tariff Free Status: In Detail

Our equipment comes under the general HS code and description:

“8486: Machines and apparatus of a kind used solely or principally for the manufacture of semiconductor boules or wafers, semiconductor devices, electronic integrated circuits or flat panel displays; machines and apparatus specified in Note 9 (C) to this Chapter; parts and accessories.”

For a detailed listing of 8486 classifications follow the link 8486 Details

The HS code we quote above is 8486 2000 00 for “Machines and apparatus for the manufacture of semiconductor devices or of electronic integrated circuits:”

The EU Tariffs for any equipment falling under HS code 8486 are detailed on the European Commission Market Access database here EU Commission MAD .

Note: There are “No available tariffs…”

The legal documentation detailing this tariff free status is here EU-import-tariffs . The relevant section begins at page 516.

The only listings that apply to Laurell Technologies equipment are detailed on page 560, and are copied below:

© 2010–2026 Laurell Technologies Corporation